Publicaciones educativas. Mis graficos publicados trato de identificar lo que parece quiere hacer la tendencia con los respectivos rompimientos de soportes y resistencias en combinacion con estudios tecnicos. No hago sugerencias de compra o venta, trato de operar lo que estoy viendo no lo que creo pueda ocurrir.

miércoles, 30 de junio de 2010

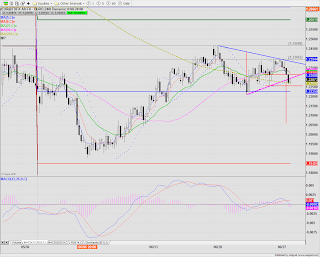

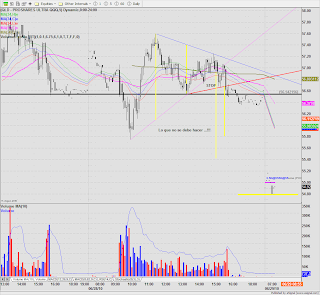

EUR Diario

martes, 29 de junio de 2010

The Third Depression

The Third Depression

By PAUL KRUGMAN

Published: June 27, 2010

Recessions are common; depressions are rare. As far as I can tell, there were only two eras in economic history that were widely described as “depressions” at the time: the years of deflation and instability that followed the Panic of 1873 and the years of mass unemployment that followed the financial crisis of 1929-31.

We are now, I fear, in the early stages of a third depression. It will probably look more like the Long Depression than the much more severe Great Depression. But the cost — to the world economy and, above all, to the millions of lives blighted by the absence of jobs — will nonetheless be immense.

By PAUL KRUGMAN

Published: June 27, 2010

Recessions are common; depressions are rare. As far as I can tell, there were only two eras in economic history that were widely described as “depressions” at the time: the years of deflation and instability that followed the Panic of 1873 and the years of mass unemployment that followed the financial crisis of 1929-31.

We are now, I fear, in the early stages of a third depression. It will probably look more like the Long Depression than the much more severe Great Depression. But the cost — to the world economy and, above all, to the millions of lives blighted by the absence of jobs — will nonetheless be immense.

Europe Double-Dip May Bring Correction: Roubini

Europe Double-Dip May Bring Correction

Economic woes in Europe could spread to the U.S. and lead to a further correction in stock prices, Nouriel Roubini, chairman of Roubini Global Economics

The weaker euro will affect US exports, the widening of credit spreads will push up bond yields, risk aversion has been rising and bank spreads affect the euro-dollar Libor rate, Roubini said.

"What is happening in the euro zone right now is going to have a negative effect on U.S. economic growth," he predicted.

"There's contagion coming from Europe to the U.S., that's a first thing," he said. Secondly, "too many governments decided to do fiscal austerity too soon."

"A double-dip recession looks likely in the euro zone, it looks like Japan right now is falling off the cliff … and now there is evidence of a slowdown in economic growth also in China

Economic woes in Europe could spread to the U.S. and lead to a further correction in stock prices, Nouriel Roubini, chairman of Roubini Global Economics

The weaker euro will affect US exports, the widening of credit spreads will push up bond yields, risk aversion has been rising and bank spreads affect the euro-dollar Libor rate, Roubini said.

"What is happening in the euro zone right now is going to have a negative effect on U.S. economic growth," he predicted.

"There's contagion coming from Europe to the U.S., that's a first thing," he said. Secondly, "too many governments decided to do fiscal austerity too soon."

"A double-dip recession looks likely in the euro zone, it looks like Japan right now is falling off the cliff … and now there is evidence of a slowdown in economic growth also in China

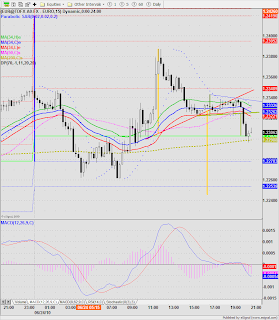

QLD 5 min

- Swing Point del Nasdaq, DIA y SPY

- Una muy mala operacion por la tequedad haberme quedado comprado a pesar del doji, sp de los indices y 0.62 fib ret de 4hrs del dia de ayer.

- Ya despues del rompimiento del grafico de 5 minutos debia haber liquidado mi perdida y no haber dejado la noche correr esta.

- Mientras la tendencia este como esta, es de muy alto riesgo dejar abierta la operacion, no hay que luchar contra esta, es la gran leccion y rompimiento es rompimiento.

lunes, 28 de junio de 2010

domingo, 27 de junio de 2010

viernes, 25 de junio de 2010

jueves, 24 de junio de 2010

Trichet Explains Why Soros Is Wrong About the Euro

Trichet Explains Why Soros Is Wrong About the Euro

"By insisting on pro-cyclical policies, Germany is endangering the European Union," Soros warned. "I realize that this is a grave accusation, but I am afraid it is justified."

"By insisting on pro-cyclical policies, Germany is endangering the European Union," Soros warned. "I realize that this is a grave accusation, but I am afraid it is justified."

Soros Says the Euro is a Flawed Construct

Soros Says the Euro is a Flawed Construct

Soros said the euro was an incomplete currency from the start as the European Union's Maastricht Treaty established a monetary union without a political union.

"The euro is a patently flawed construct," Soros, who earned $1 billion in 1992 by betting against the British pound, said in the text of a speech for delivery at Berlin's Humboldt University.

Soros said the euro was an incomplete currency from the start as the European Union's Maastricht Treaty established a monetary union without a political union.

"The euro is a patently flawed construct," Soros, who earned $1 billion in 1992 by betting against the British pound, said in the text of a speech for delivery at Berlin's Humboldt University.

miércoles, 23 de junio de 2010

Suscribirse a:

Entradas (Atom)