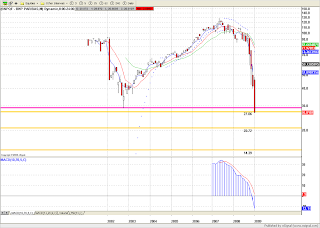

Stocks wrapped up their worst January on record with a final plunge on Friday.

The Dow Jones Industrial Average finished January down 8.84% on the month. Perviously, the worst January for the Dow had been that of 1916, when it fell 8.64%. Friday, the Dow dropped 148.15 points to 8000.86 after briefly dipping below the 8000 mark. The Dow has fallen five straight months and in 12 of the last 15.

The S&P 500-stock index lost 2.28% Friday to end at 825.88, for cumulative losses in January of 8.57%. Until Friday, its worst January from 1929 onward occurred in 1970, when it lost 7.65%.

Both stock-market indexes are off by more than 40% from their 2007 highs.

Stocks popped at the open Friday, but spent most of the day in the red. Traders cited fears that plans wouldn't go forward for a so-called bad bank to soak up toxic assets from financial institutions, and bleak economic news, in particular Friday's report of a 3.8% contraction in fourth quarter GDP. It was better than the 5.5% fall that economists had expected, but suggested the recession, now in its second year, is cutting deep.

A slew of layoff announcements, skepticism of the Obama stimulus plan, and a series of bleak earnings reports all crunched U.S. stock markets over the course of the week. Those developments left investors who exited stocks last year with little desire to put their money to work in the markets, limiting any stock rallies.

"I don't think anyone is willing to put money to work until we get clarity out of the new government," said Matthew Cheslock, managing director at Cohen Capital Group LLC.

Investors have grown wary of efforts to right the ship. The Obama stimulus plan has received a lukewarm reception among market participants and buzz about the possible creation of a "bad bank" to soak up toxic assets has waxed and waned, perplexing investors. After a three-day jump to start the week, the bottom dropped out for stocks on Thursday and Friday.

"There's been too much back-and-forth, it's a wishy-washy market," said Debra Brede, president of D.K. Brede Investment Management Company. "One day you think [the government] is going to do something serious to help the banks, and the next day it's not such a great idea. Markets hate uncertainty, and it's not clear it's a good plan. We need to get these banks cleaned up and move forward."

Historically, stocks' January performance has been thought of as an informal indicator for the market's direction the rest of the year. When the S&P declines in January, the index loses an average of 2.4% in the next 11 months, according to data going back to 1950 from Ned Davis Research. When the S&P climbs in January, the index posts an average gain of 12.3% in the next period.

"We're at month-end, the Dow is down, and there's no ray of sunshine," said Mr. Cheslock. "We need to get expectations down -- it's good for the market over the long term. Last quarter was horrible, this quarter will probably be horrible."

On Friday, Dow component Procter & Gamble lost 6.2% after cutting its sales forecast for the year after a 53% increase in earnings in its just-ended quarter. Oil giant Exxon Mobil's fourth quarter net fell 33% even as its annual results hit a new record. Rival Chevron posted a razor-thin profit increase for the fourth quarter. The two Dow components ended with modest losses.

Industrial stocks sold off, with Caterpillar warning it must drastically reduce production this year. Its shares fell 3.1%. Alcoa slid 7.7%. These stocks have plumbed new depths after repeated warnings from the International Monetary Fund and others that global growth is going to slow to a "virtual standstill" in 2009.

Gold and the U.S. dollar were among Friday's few silver linings. The dollar rose 1.23% against the euro. February gold gained 2.5%, ending at $927.30.

"The dollar seems to have some strength, but I think gold is telling the real story here," said Axel Merk, president and chief investment officer at Merk Investments. Investors no longer favor any particular currency, Mr. Merk said, because of "[worries] about what governments may do to their currencies. Everyone wants to weaken their currencies to finance growth. There are depression fears spreading around the world."

March crude futures fell 6.6% in January to settle at $41.68. Crude is down for the seventh consecutive month.