Publicaciones educativas. Mis graficos publicados trato de identificar lo que parece quiere hacer la tendencia con los respectivos rompimientos de soportes y resistencias en combinacion con estudios tecnicos. No hago sugerencias de compra o venta, trato de operar lo que estoy viendo no lo que creo pueda ocurrir.

miércoles, 31 de octubre de 2007

martes, 30 de octubre de 2007

lunes, 29 de octubre de 2007

martes, 23 de octubre de 2007

jueves, 18 de octubre de 2007

US FED: Beige Book

U.S. Economic Analysis

14:41 US FED: Beige Book - Moderate, Modest and Mixed; Diffusion Up Boston, October 17. The latest edition of the Beige Book shows vigilance but a lack of evidence of spillovers from the housing collapse. Business contacts said economic activity decelerated since August but they did not say it declined. Nevertheless, businesses are cautious and uncertain about the economic outlook. The expansion was variously characterized as "moderate," "modest" and "mixed." In the summary, prepared by the Dallas Fed on information collected on or before October 5 (so it may or may not include reaction to the September jobs report), growth was said to be "similar to that observed in the last Beige Book in seven Districts -- Atlanta, Boston, Chicago, Minneapolis, New York, Philadelphia and St. Louis." The economy grew at a slower rate in five Districts -- Cleveland, Dallas, Kansas City, Richmond and San Francisco. This was a soft Beige Book but not as soft as the rapid credit market deterioration in July and August would have suggested two months later.

Key points:

* Services activity was generally neutral to positive.

* Uncertain outlook for retail sales; retailers reducing inventories

* Four districts indicated "solid growth" in factory activity

* Residential real estate and construction off further; commercial steady

* Continued downtrend in demand for residential mortgages; personal loans up

* Increased delinquencies and deteriorated credit quality

* Positive activity in energy and mining

* Labor markets remain tight; worker shortages in variety of occupations

* Moderate to steady wage advances; upward pressure on input costs We've tried to take an empirical approach to the Beige Book reports. Searching the full report, we isolate negative words such as weak, weaker, weakening, soft, softness, slowing, down and downward (among others). On the positive side, we count words like strong, strength, solid, up, upward, uptick, higher, etc. We diffuse the negatives and positives to come up with an index and what we came up with for the latest Beige Book (-0.4) is actually better than either the January 17 (-1.6) or the September 5 report (-5.8).

14:41 US FED: Beige Book - Moderate, Modest and Mixed; Diffusion Up Boston, October 17. The latest edition of the Beige Book shows vigilance but a lack of evidence of spillovers from the housing collapse. Business contacts said economic activity decelerated since August but they did not say it declined. Nevertheless, businesses are cautious and uncertain about the economic outlook. The expansion was variously characterized as "moderate," "modest" and "mixed." In the summary, prepared by the Dallas Fed on information collected on or before October 5 (so it may or may not include reaction to the September jobs report), growth was said to be "similar to that observed in the last Beige Book in seven Districts -- Atlanta, Boston, Chicago, Minneapolis, New York, Philadelphia and St. Louis." The economy grew at a slower rate in five Districts -- Cleveland, Dallas, Kansas City, Richmond and San Francisco. This was a soft Beige Book but not as soft as the rapid credit market deterioration in July and August would have suggested two months later.

Key points:

* Services activity was generally neutral to positive.

* Uncertain outlook for retail sales; retailers reducing inventories

* Four districts indicated "solid growth" in factory activity

* Residential real estate and construction off further; commercial steady

* Continued downtrend in demand for residential mortgages; personal loans up

* Increased delinquencies and deteriorated credit quality

* Positive activity in energy and mining

* Labor markets remain tight; worker shortages in variety of occupations

* Moderate to steady wage advances; upward pressure on input costs We've tried to take an empirical approach to the Beige Book reports. Searching the full report, we isolate negative words such as weak, weaker, weakening, soft, softness, slowing, down and downward (among others). On the positive side, we count words like strong, strength, solid, up, upward, uptick, higher, etc. We diffuse the negatives and positives to come up with an index and what we came up with for the latest Beige Book (-0.4) is actually better than either the January 17 (-1.6) or the September 5 report (-5.8).

lunes, 15 de octubre de 2007

U.S. options traders think we’re in for a crash

U.S. options traders think we’re in for a crash. Options traders are becoming increasingly nervous about the U.S. stock market’s record-setting rally of late. In fact, they are paying the most ever to protect against an S&P swoon – as per data compiled by Morgan Stanley. The gap between the price of the put options and the cost to wager on further gains has averaged about eight percentage points since August. That’s more than the previous high in July 2001, before the index dropped 34%, and swooned to its lowest level this decade.

It looks like traders aren’t taking any chances this time around. They are pricing in the highest risk of an equity market decline, since the technology-stock bubble at the start of the decade – again, this from Morgan Stanley. According to that source, implied volatility is suggesting that many traders are betting on stocks falling. That measure calculates expected price swings of an underlying asset, and is used as a barometer for options prices. July 2001 was the last time the skew steepened as much. In the ensuing 15 months, the U.S. economy suffered its first recession in a decade, and the S&P 500 fell accordingly.

Source: National Post/Financial Post – Bloomberg News, Tue., Oct. 9/07

It looks like traders aren’t taking any chances this time around. They are pricing in the highest risk of an equity market decline, since the technology-stock bubble at the start of the decade – again, this from Morgan Stanley. According to that source, implied volatility is suggesting that many traders are betting on stocks falling. That measure calculates expected price swings of an underlying asset, and is used as a barometer for options prices. July 2001 was the last time the skew steepened as much. In the ensuing 15 months, the U.S. economy suffered its first recession in a decade, and the S&P 500 fell accordingly.

Source: National Post/Financial Post – Bloomberg News, Tue., Oct. 9/07

jueves, 11 de octubre de 2007

miércoles, 10 de octubre de 2007

martes, 9 de octubre de 2007

miércoles, 3 de octubre de 2007

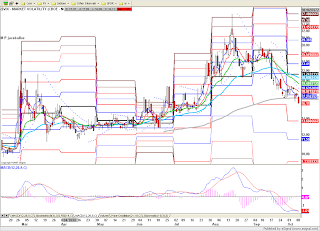

QQQQ Diario

Suscribirse a:

Entradas (Atom)