Publicaciones educativas. Mis graficos publicados trato de identificar lo que parece quiere hacer la tendencia con los respectivos rompimientos de soportes y resistencias en combinacion con estudios tecnicos. No hago sugerencias de compra o venta, trato de operar lo que estoy viendo no lo que creo pueda ocurrir.

viernes, 2 de octubre de 2009

US Dollar DXY

Desempleo mundial

The following chart compares the latest unemployment rate for all of the major countries with that of its 17 year average (which is as far back as our data goes). The unemployment rate in the U.S. as of Sept 2009 is 9.8 percent compared to an average unemployment rate over the past 17 years of 5.5 percent. The difference of 4.2 percent suggests that there is a lot of additional slack in the U.S. economy. In contrast, the average unemployment rate in Germany is 9.83 percent compared to a current unemployment rate of 8.3 percent. This suggests that over the past 17 years, more people have accumulated jobs in Germany. The same is true for Australia and New Zealand who benefited materially from China’s rapid development China over the past 2 decades. Therefore we have good reasons to believe that the countries with the greatest excess capacity and the highest differential between the current unemployment rate and that of the 17 year average is most likely to keep interest rates on hold for the longest period of time. In contrast, for the countries where are the unemployment is below the average, the central bank may be itching to raise interest rates. This is particularly important ahead of next week's interest rate decisions from Australia, the U.K. and the Eurozone. The IMF has already called for the RBA to start tightening monetary policy while Market News reported this morning that the ECB is discussing moving to a tightening bias.

EUR 60 min

- Falso rompimiento despues de cumplir proy en 15 min dejando DP

- Cumplimiento de proy a nivel de S1 semanal

Etiquetas:

FX EUR,

Pivots Mensuales,

Proyecciones

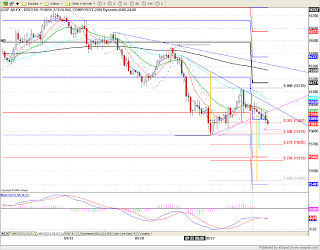

EUR 60 min

- Cumplimiento proy 15 min a nivel de pivot

- Atentos linea horizontal roja, los cuerpos no cierran por debajo de esta..!!

- Atentos posible formacion DP

- 21 emas continuan acuando como resistencia, atentos a esta ema

Etiquetas:

Divergencia Positiva,

FX EUR,

Pivots Semanales

EUR 15 min

- Cumplimiento primer target a nivel de S4 semanal y S2 diario

- Sostenido los cierres por arriba del canal lateral

Etiquetas:

FX EUR,

Pivots Diarios,

Proyecciones

Suscribirse a:

Comentarios (Atom)